Tag: DepthPR

NotaryCam hires Suzanne Singer as Director of Sales and Marketing

NEWPORT BEACH, Calif., May 16, 2023 (SEND2PRESS NEWSWIRE) -- NotaryCam®, a Stewart-owned company and a pioneering provider of remote online notarization and identity verification/authentication technology for real estate and legal transactions, today announced that Suzanne Singer has been appointed director of sales and marketing.

Denver Post Names ACES Quality Management a Recipient of Colorado Top Workplaces 2023 Award

DENVER, Colo., May 11, 2023 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced it has been awarded a Top Workplaces 2023 honor by Denver Post Top Workplaces. ACES Quality Management is the leading provider of enterprise quality management and control software for the financial services industry.

Melinda Harris of Down Payment Resource named a 2023 Trailblazer by PROGRESS in Lending Association

ATLANTA, Ga., May 10, 2023 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, today announced that Director of Marketing Melinda Harris was selected to PROGRESS in Lending Association's list of 2023 Sales, Marketing and Public Relations Trailblazers.

Houston Association of Realtors implements Down Payment Resource to engage homebuyers with affordable pathways to homeownership

ATLANTA, Ga., May 9, 2023 (SEND2PRESS NEWSWIRE) -- The Houston Association of REALTORS® (HAR) has implemented Down Payment Resource (DPR) to bring Greater Houston area homebuyers' attention to homebuyer assistance programs in the wake of declining housing affordability. Data indicates that homebuyer assistance programs can be especially impactful in the Greater Houston area, where 89% of listings are eligible for assistance and HAR reports that only 40% of households could afford to buy a home in Q4 2022.

Georgeo Pulikkathara joins Dovenmuehle as Chief Information Security Officer

LAKE ZURICH, Ill., May 9, 2023 (SEND2PRESS NEWSWIRE) -- Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, announced today that it has hired Georgeo Pulikkathara as the company's Chief Information Security Officer (CISO). In this role, he will be responsible for the information security at Dovenmuehle, protecting data security and privacy, including borrowers' nonpublic personal information (NPI) and ensuring that Dovenmuehle maintains the appropriate internal systems, organization and information security controls necessary for financial reporting and protecting clients' confidential data.

NotaryCam’s Brian Webster named Inman Best of Finance award winner

NEWPORT BEACH, Calif., May 5, 2023 (SEND2PRESS NEWSWIRE) -- NotaryCam®, a Stewart-owned company and a pioneering provider of remote online notarization and identity verification/authentication technology for real estate and legal transactions, today announced that NotaryCam president Brian Webster has been recognized as one of 2023's Best in Finance by Inman. The Inman Best of Finance Awards celebrate those at the forefront of the mortgage and finance space.

LenderLogix enhances LiteSpeed point-of-sale platform to support communication with Spanish-speaking mortgage borrowers

BUFFALO, N.Y., May 5, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced its streamlined point-of-sale (POS) LiteSpeed now offers a Spanish version of the residential loan application to support communication with Spanish-speaking borrowers in their native language.

FormFree’s Brent Chandler named an Inman Best of Finance award honoree

ATHENS, Ga., May 3, 2023 (SEND2PRESS NEWSWIRE) -- FormFree® today announced that its founder and CEO Brent Chandler was named to Inman's 2023 Best of Finance award program, which recognizes the leaders who are reshaping the mortgage and finance industries for both professionals and consumers. The inaugural class of Inman's Best of Finance winners were honored for their unwavering commitment to innovation and service in the residential mortgage space.

Down Payment Resource adds four team members to help the housing industry meet strong consumer demand for homebuyer assistance programs

ATLANTA, Ga., May 2, 2023 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, today announced that it has brought on four new team members to grow its sales footprint, expand its relationships with housing finance agencies (HFAs) and provide enhanced support to DPR's growing customer base.

Nomis Solutions Joins FIS Emerald Conference 2023 as Silver Sponsor, May 15-18 at Walt Disney World resorts in Orlando

ORLANDO, Fla. /FLORIDA NEWSWIRE/ -- Nomis Solutions (Nomis), the leading provider of end-to-end pricing lifecycle management technology, announces its sponsorship of the FIS Emerald 2023 Conference, which will be held May 15-18 at Walt Disney World resorts in Orlando, Fla., hosted by FIS Global, a global leader in financial services technology.

ACES Quality Management unveils ACES PROTECT® mortgage compliance testing module

DENVER, Colo., May 1, 2023 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announces the addition of ACES PROTECT, a suite of automated regulatory compliance tests, to its flagship ACES Quality Management & Control® quality control (QC) auditing platform.

Peak Residential Lending Builds Digital-First Mortgage Borrowing Experience Using LenderLogix Product Suite

BUFFALO, N.Y., April 27, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced Peak Residential Lending has implemented its complete application suite - LiteSpeed, QuickQual and Fee Chaser - into its existing tech stack to power a digital-first borrower experience.

MMI appoints Brian McKray as director of product development

SALT LAKE CITY, Utah, April 26, 2023 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it has hired Brian McKray as the director of product development. In this role, McKray will guide the creation of new system features and functionality to maintain alignment with the company's vision and mission and ensure customer needs are considered at every stage of product development.

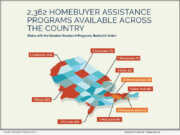

Down Payment Resource Issues Q1 2023 Homeownership Program Index Report

ATLANTA, Ga., April. 25, 2023 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, issued its Q1 2023 Homeownership Program Index (HPI). The firm's analysis revealed a 0.5% uptick in the number of homebuyer assistance programs available to help people finance homes, raising the number of programs to 2,362.

MMI adds video production tool to platform for loan originator promotion

SALT LAKE CITY, Utah, April 20, 2023 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it has released LO Highlight Reels, an easy-to-use video creation tool for loan originators (LOs) looking for an eye-catching way to share their success and increase their visibility.

Sales Boomerang releases Q1 2023 Mortgage Market Opportunities Report

OWINGS MILLS, Md., April 20, 2023 (SEND2PRESS NEWSWIRE) -- TrustEngine™, a provider of data-driven homebuyer engagement and education solutions for lenders, today announced the release of Sales Boomerang's latest Mortgage Market Opportunities Report. The Q1 2023 report indicates quarter-over-quarter improvements across all indicators of mortgage readiness, representing growth in mortgage lending opportunities.

MMI increases platform’s business intelligence and expands mortgage and real estate data analytics capabilities with its Custom Dashboard Hub

SALT LAKE CITY, Utah, April 13, 2023 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced today it has launched its new Custom Dashboard Hub and expanded the business intelligence (BI) tools available on its platform, increasing users' ability and ease in developing strategy, recruiting, nurturing talent and discovering new opportunities.

SOC 1 and 2 reports affirm Dovenmuehle’s stable and secure mortgage subservicing operations

LAKE ZURICH, Ill., April 11, 2023 (SEND2PRESS NEWSWIRE) -- Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, announced today that public accounting and business advisory firm Plante Moran, PLLC has completed an annual review of Dovenmuehle's subservicing operations and published its findings via Service Organization Control (SOC) 1® Type 2 and SOC 2® Type 2 reports.

iEmergent shares top takeaways from 2022 HMDA data

DES MOINES, Iowa, April 6, 2023 (SEND2PRESS NEWSWIRE) -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the immediate availability of 2022 Home Mortgage Disclosure Act (HMDA) data in Mortgage MarketSmart. To celebrate providing lenders with early access to HMDA reporting, iEmergent CEO Laird Nossuli shared summary observations drawn from the loan-level origination data.

Rob Chrane of Down Payment Resource honored as a 2023 Tech All-Star by Mortgage Bankers Association

ATLANTA, Ga., April 3, 2023 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, announced today that its founder and CEO Rob Chrane has been named a 2023 MBA NewsLink Tech All-Star by the Mortgage Bankers Association (MBA). The MBA is the leading professional group for the mortgage industry with more than 2,100 member companies.