Tag: Finance

MCT AOT Automation Improves Mortgage Lender Profitability and Investor Efficiency

SAN DIEGO, Calif., April 13, 2023 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that it has automated the process of digital TBA trade assignment during the loan sale process for both mortgage lenders and participating correspondent investors. This automation makes assignment of trade loan sales (AOTs) faster, more convenient, and easier for investors to offer.

TurboTenant and Armadillo: Simplifying Self-Management for Landlords

FORT COLLINS, Colo. and LOUISVILLE, Ky., April 13, 2023 (SEND2PRESS NEWSWIRE) -- Armadillo, a modern tech-enabled home warranty platform, and TurboTenant, a digital one-stop-shop for landlords looking to simplify then scale their rental business, have launched a partnership to provide landlords with an affordable and comprehensive protection plan for their rental properties.

SOC 1 and 2 reports affirm Dovenmuehle’s stable and secure mortgage subservicing operations

LAKE ZURICH, Ill., April 11, 2023 (SEND2PRESS NEWSWIRE) -- Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, announced today that public accounting and business advisory firm Plante Moran, PLLC has completed an annual review of Dovenmuehle's subservicing operations and published its findings via Service Organization Control (SOC) 1® Type 2 and SOC 2® Type 2 reports.

iEmergent shares top takeaways from 2022 HMDA data

DES MOINES, Iowa, April 6, 2023 (SEND2PRESS NEWSWIRE) -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the immediate availability of 2022 Home Mortgage Disclosure Act (HMDA) data in Mortgage MarketSmart. To celebrate providing lenders with early access to HMDA reporting, iEmergent CEO Laird Nossuli shared summary observations drawn from the loan-level origination data.

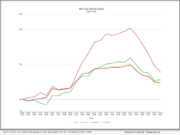

MCTlive! Lock Volume Indices: March 2023 Data

SAN DIEGO, Calif., April 5, 2023 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for March 2023. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

Fernando S. Ereneta, CFP® – CEO of Legacy Wealth Advisors has been named to the Forbes Best-in-State Wealth Advisor List for...

WARRENVILLE, Ill., April 5, 2023 (SEND2PRESS NEWSWIRE) -- Raymond James Financial Services is proud to announce that Fernando S. Ereneta of Legacy Wealth Advisors has once again been named to the Forbes Best-in-State Wealth Advisor list! The recently released list recognizes advisors and practices on a state-by-state basis from national, regional and independent firms.

Rob Chrane of Down Payment Resource honored as a 2023 Tech All-Star by Mortgage Bankers Association

ATLANTA, Ga., April 3, 2023 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, announced today that its founder and CEO Rob Chrane has been named a 2023 MBA NewsLink Tech All-Star by the Mortgage Bankers Association (MBA). The MBA is the leading professional group for the mortgage industry with more than 2,100 member companies.

IndiSoft partners with FormFree to streamline the delivery of housing counseling services to underserved consumers

ATHENS, Ga., March 30, 2023 (SEND2PRESS NEWSWIRE) -- FormFree® today announced that developer of collaborative solutions for the housing finance industry, IndiSoft, is leveraging FormFree's Passport® to enable HUD-approved housing counseling agencies (HCAs) to provide more effective and expeditious consumer counseling.

MMI Announces Small and Mid-Size Business Channel and New Account Executive, Heath Liles

SALT LAKE CITY, Utah, March 30, 2023 (SEND2PRESS NEWSWIRE) - Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it has expanded access to its platform with a new user tier for small and mid-size (SMB) independent mortgage lenders and brokers. Previously focused on enterprise accounts, MMI is now making a dedicated effort to providing value to the individual and SMB spaces.

Accounting Today Names KROST Top 100 Firm and Regional Leader 2023

LOS ANGELES, Calif., March 29, 2023 (SEND2PRESS NEWSWIRE) -- KROST has been recognized as a Top 100 Firm by Accounting Today for the third year in a row. The firm ranked 72nd with a 16.60% change in revenue from the previous year. In addition, KROST has also been named a Regional Leader of 2023. The firm recently launched a new service, KROST Fund Admin Solutions, to further assist and add value for their clients.

Dovenmuehle adds Anna Krogh as Vice President of Business Development to expand mortgage subservicer’s footprint

LAKE ZURICH, Ill., March 29, 2023 (SEND2PRESS NEWSWIRE) -- Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, announced today that Anna Krogh has been hired as the company's vice president of business development. In this role, her responsibilities will include growing Dovenmuehle's client list by sourcing new prospects and fostering and developing long-term relationships and clients.

Strategic Capital Becomes a Texas Trial Lawyers Association Sustaining Partner

LOS ANGELES, Calif. and NEW YORK, N.Y., March 28, 2023 (SEND2PRESS NEWSWIRE) -- For years, Strategic Capital has worked closely as a partner of the Texas Trial Lawyers Association (TTLA), sponsoring events and working alongside TTLA attorneys to help clients best manage their settlements. Now, though, this relationship takes a step forward. Strategic Capital is officially a Texas Trial Lawyers Association Sustaining Partner, making it one of the official TTLA business partners in 2023.

Critical Defect Rate Reaches Report-High in Q3 2022, Per ACES Quality Management Mortgage QC Industry Trends Report

DENVER, Colo., March 23, 2023 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the third quarter (Q3) of 2022. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

78.9% of metro Atlanta residential housing inventory is eligible for down payment assistance – offsetting price and interest rate impact for...

ATLANTA, Ga., March 21, 2023 (SEND2PRESS NEWSWIRE) -- As metro Atlanta homebuyers encounter the challenging trifecta of sharply rising home prices, elevated interest rates and institutional investor depletion of starter home inventory, Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, released a comprehensive report on the 46 active metro Atlanta homebuyer assistance programs.

S&P Global Ratings affirms Dovenmuehle’s Above Average rating and stable outlook

LAKE ZURICH, Ill., March 21, 2023 (SEND2PRESS NEWSWIRE) -- Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, announced today that Standard & Poor's Global Ratings (S&P) has affirmed its Above Average rating of Dovenmuehle as a residential mortgage loan primary servicer with a stable outlook. Dovenmuehle has been ranked as Above Average by S&P for the past 12 years without interruption.

The Mortgage Firm selects LiteSpeed from LenderLogix as its POS Platform

BUFFALO, N.Y., March 21, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced The Mortgage Firm, a Florida-based independent retail mortgage lender with branches located throughout the U.S., has selected its streamlined point-of-sale (POS) platform LiteSpeed to power its application process and deliver a superior borrower experience at the initial point of contact.

Nomis Solutions Featured in Tech Demo Super Session at Consumer Bankers Association Live Conference in Las Vegas March 27-29

SAN FRANCISCO, Calif., March. 20, 2023 (SEND2PRESS NEWSWIRE) -- Nomis Solutions (Nomis), the leading provider of end-to-end pricing lifecycle management technology, announces its sponsorship of the Consumer Bankers Association (CBA) annual conference, 'LIVE.' In addition to the sponsorship, Nomis will be one of 10 companies featured in CBA Live's Tech Demo Super Session. The session explores innovations from top financial service providers including Salesforce, Blend and Glia.

Tax Court Case: Engineering Firm Overstated §179D Energy Efficient Commercial Building Property Deduction

COLUMBUS, Ohio, March 16, 2023 (SEND2PRESS NEWSWIRE) -- In a recent case, Michael Johnson, et ux. v. Commissioner, the tax court denied the majority of a taxpayer's Energy Efficient Commercial Building Deduction under IRC §179D since it claimed a §179D Deduction exceeding the cost of the Energy Efficient Commercial Building Property (EECBP), says ICS Tax, LLC.

LenderLogix increased organic growth by 150% amongst its client base of independent mortgage lenders, banks and credit unions in 2022

BUFFALO, N.Y., March 16, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced significant growth within its client base in 2022, increasing its number of partnered lending institutions by 150%. The company also maintained a net promoter score (NPS) of 86 based on feedback from the thousands of lenders and real estate agents that interact with LenderLogix and its suite of mortgage technology.

GreenLyne adopts FormFree’s Residual Income Knowledge Index to unlock greater inclusivity in mortgage lending

ATHENS, Ga., March 15, 2023 (SEND2PRESS NEWSWIRE) -- FormFree® today announced that Inclusive-Finance-as-a-Service platform GreenLyne has enhanced its ability to help lenders identify home financing opportunities for underserved consumers with its adoption of FormFree's Residual Income Knowledge Index™ (RIKI™).