Tag: Mortgage

Down Payment Resource debuts on the Inc. 5000 list of America’s fastest-growing companies

ATLANTA, Ga., Aug. 15, 2023 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced it has earned a spot on the 2023 Inc. 5000 list of the nation's fastest-growing private companies. This marks DPR's inaugural year on the list.

MMI provides access to loan originator production data with LO Quick Profiles

SALT LAKE CITY, Utah, Aug. 14, 2023 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced the release of its new LO Quick Profile search tool, which provides a summary view of a loan originator's (LO) production and top referral partners.

MCT Appoints Steve Pawlowski Head of Technology Solutions to Continue Industry-Changing Innovation

SAN DIEGO, Calif., Aug. 10, 2023 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the appointment of Steve Pawlowski as Managing Director, Head of Technology Solutions. Mr. Pawlowski will be responsible for expanding upon MCT's proven record of driving efficiency and liquidity in the secondary market. He will report directly to MCT's COO, Phil Rasori.

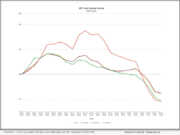

July’s Mortgage Lock Volume Flat Amongst Rising Rates in Latest MCT Indices Report

SAN DIEGO, Calif., Aug. 4, 2023 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a relatively flat .44% increase in mortgage lock volume over the prior month. Visit MCT's site to download the full report.

Northwest Bank Collects Fees within Minutes with LenderLogix FeeChaser

BUFFALO, N.Y., Aug. 2, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced Northwest Bank has selected its payment processing platform Fee Chaser to ensure compliant collection of upfront fees and deliver borrowers a five-star digital experience.

HousingWire honors TrustEngine Vice President Rachel Cunningham as a 2023 Women of Influence

ELLICOTT CITY, Md., Aug. 1, 2023 (SEND2PRESS NEWSWIRE) -- TrustEngine™, a provider of data-driven homebuyer engagement and education solutions for lenders, today announced Vice President of Customer Success Rachel Cunningham has been named a HousingWire 2023 Women of Influence award honoree. The Women of Influence awards program recognizes the achievements of women who are shaping the U.S. housing economy.

LenderLogix Q2 2023 Homebuyer Intelligence Report Data Shows Slight Increase in Homebuying Activity Despite Affordability and Inventory Challenges

BUFFALO, N.Y., July 26, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools.

TrustEngine releases Q2 2023 Mortgage Market Opportunities Report

ELLICOTT CITY, Md., July 26, 2023 (SEND2PRESS NEWSWIRE) -- TrustEngine™, a provider of data-driven homebuyer engagement and education solutions for lenders, today announced the release of its latest Mortgage Market Opportunities Report analyzing trends in the frequency of different types of mortgage opportunity alerts through June 2023.

Down Payment Resource Issues Q2 2023 Homeownership Program Index Report

ATLANTA, Ga., July 24, 2023 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, issued its Q2 2023 Homeownership Program Index (HPI). The firm's analysis revealed a second consecutive quarterly uptick of 0.5% in the number of homebuyer assistance programs available to help people finance homes, raising the number of programs to 2,373.

iEmergent CEO Laird Nossuli named to MPA’s 2023 list of Elite Women in Mortgage

DES MOINES, Iowa, July 11, 2023 (SEND2PRESS NEWSWIRE) -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, announced today that CEO Laird Nossuli has been named to Mortgage Professional America (MPA) magazine's 2023 list of Elite Women in Mortgage.

Down Payment Resource Reports on Homebuyer Assistance Programs for People with Disabilities for Disability Pride Month

ATLANTA, Ga., July 10, 2023 (SEND2PRESS NEWSWIRE) -- In celebration of Disability Pride Month, Down Payment Resource (DPR) has issued a report on the 23 U.S. homebuyer assistance programs that are specifically designed to support people with disabilities and their family caregivers on their journey towards homeownership. While people with disabilities may be eligible for any of the 2,300-plus U.S. homebuyer assistance programs, this report sheds light on programs specially developed to promote accessibility and inclusivity for aspiring homeowners with disabilities.

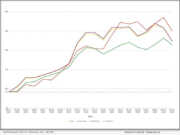

Monthly Lock Volume Increases 31% in Latest MCT Indices Report

SAN DIEGO, Calif., July 7, 2023 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a 31% increase in lock volume in June. Visit MCT's website to download the full report. The increase in June's lock volume activity, which is based on actual locked loans, comes after a 15% drop in May's total lock production.

Agile Appoints Greg Vacura as President to Further Mission of Creating a Better MBS Market

PHILADELPHIA, Pa., June 28, 2023 (SEND2PRESS NEWSWIRE) -- Agile, a groundbreaking fintech bringing mortgage lenders and broker dealers together on a single electronic platform, today announced the appointment of Greg Vacura as company president. Mr. Vacura will be working to fulfill Agile's mission to create a better mortgage-backed securities (MBS) market through increasing liquidity and automation in TBAs, MBS pools, and AOTs.

Depth welcomes Berry College communications major Jasmynn Innis for summer internship

ATLANTA, Ga., June 28, 2023 (SEND2PRESS NEWSWIRE) -- Depth, the leading provider of consultative B2B marketing, public relations and reputation management services for mortgage fintech innovators, the residential finance industry and technology for emerging regulated markets (regtech), welcomes Berry College communications major Jasmynn Innis as its 2023 summer intern.

Premium Mortgage Corporation taps LenderLogix’s LiteSpeed to power Digital-First Mortgage Borrowing Experience

BUFFALO, N.Y., June 28, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Rochester, N.Y.-based Premium Mortgage Corporation (Premium Mortgage) is the latest mortgage lender to implement its streamlined point-of-sale (POS) platform LiteSpeed to provide borrowers with a white-labeled, digitally-driven mortgage application experience.

MMI releases referral partnership ROI Calculator

SALT LAKE CITY, Utah, June 23, 2023 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced the release of its ROI Calculator, an easy-to-use tool for lenders to see the impact their referral partnerships have on production volume.

ACES Quality Management named 2023 Best Places to Work in Financial Technology

DENVER, Colo., June 16, 2023 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has been named one of the 2023 Best Places to Work in Financial Technology. The awards program was created in 2017 and is a project of Arizent and Best Companies Group.

Q4 2022 ACES Mortgage QC Industry Trends Report Shows Decline in Critical Defect Rate to 1.84%

DENVER, Colo., June 15, 2023 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) of 2022, as well as the full calendar year (CY).

Nomis Solutions hires Amy Chase as Senior Vice President of Services

SAN FRANCISCO, Calif., June 13, 2023 (SEND2PRESS NEWSWIRE) -- Nomis Solutions (Nomis), the leading provider of end-to-end pricing lifecycle management technology, announced that client success veteran Amy Chase has been tapped as Senior Vice President of Services. Chase will be responsible for leading implementations of Nomis Solutions and delivering ongoing services to existing clients.

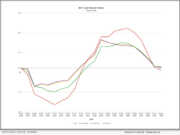

MCTlive! Lock Volume Indices: May 2023 Data

SAN DIEGO, Calif., June 8, 2023 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for May 2023. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.