Tag: Mortgage

FormFree selected to HousingWire Tech100 for the ninth year

ATHENS, Ga., March 2, 2023 (SEND2PRESS NEWSWIRE) -- FormFree® today announced its inclusion in HousingWire's (HW's) annual Tech100 list for the ninth year. The HW Tech100 Mortgage Awards recognize the U.S. housing economy's most innovative and influential fintech companies and solutions.

NotaryCam makes its 5th appearance on HousingWire’s annual Tech100 list of innovative technology

NEWPORT BEACH, Calif., March 2, 2023 (SEND2PRESS NEWSWIRE) -- NotaryCam®, a Stewart-owned company and a pioneering provider of remote online notarization and identity verification/authentication technology for real estate and legal transactions, today announced it has been selected by the publication HousingWire for its annual Tech100 awards program.

TrustEngine named to HousingWire’s 2023 Tech100 Mortgage list

OWINGS MILLS, Md., March 2, 2023 (SEND2PRESS NEWSWIRE) -- TrustEngine™, a provider of data-driven homebuyer engagement and education solutions for lenders, has been selected as a HousingWire (HW) 2023 Tech100 Mortgage Award winner. For 11 years, the HW Tech100 Awards have recognized the most innovative technology companies in the housing economy.

LenderLogix makes Second Appearance on HousingWire’s annual Tech100 list of Innovative Mortgage Technology Firms

BUFFALO, N.Y., March 2, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced it has been named to HousingWire magazine's annual Tech100 list. HousingWire's Tech100 award seeks to highlight the most innovative technology companies across the housing sector.

ACES Quality Management Makes Ninth Appearance on HousingWire Tech100 List of Top Mortgage Tech Companies

DENVER, Colo., March 2, 2023 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has been selected for the ninth consecutive year by HousingWire magazine for its annual Tech100 awards program. The magazine chose ACES for the continual innovation of its flagship quality control (QC) auditing platform ACES Quality Management & Control® software.

FormFree sharpens focus on decentralizing and democratizing consumer access to credit with strategic divestiture of AccountChek

ATHENS, Ga., March 1, 2023 (SEND2PRESS NEWSWIRE) -- Founder and CEO Brent Chandler today heralded a new era for FormFree® following its strategic divestiture of asset-verification service AccountChek®. Moving forward, the fintech will focus on products that advance its mission to decentralize and democratize the way consumers understand their financial data and access credit opportunities. Eric Lapin, who joined FormFree in 2022 as chief strategy officer, will guide the company's next chapter as president.

HomeScout partners with Down Payment Resource to capture consumer demand for homebuyer assistance program information

ATLANTA, Ga., Feb. 28, 2023 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry's leading technology for connecting home buyers with homebuyer assistance programs, today announced that it has partnered with HomeScout LLC to help mortgage lenders generate and convert more leads by meeting heightened consumer demand for information about affordable pathways to homeownership.

LenderLogix launches LiteSpeed point of sale system to address the needs of small to mid-sized mortgage lenders

BUFFALO, N.Y., Feb. 22, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced the launch of LiteSpeed, a streamlined point-of-sale (POS) system designed for small to mid-sized lenders. LiteSpeed delivers lenders the essential POS functionality they need to compete in today's digitally-driven market at a lower cost and without significant investment in the implementation and internal support larger platforms require.

Michigan Mortgage Lenders Association Announces Speaker Lineup for 2023 Sales Rally

SHELBY TOWNSHIP, Mich., Feb. 20, 2023 (SEND2PRESS NEWSWIRE) -- The Michigan Mortgage Lenders Association (MMLA), the only Michigan-based association dedicated solely to the housing finance industry, has announced the speaker lineup for its 2023 Sales Rally, taking place March 14 at the Suburban Collection Showplace in Novi, Michigan.

ACES Quality Management Taps Mortgage and Financial Services QC/Risk Experts to Headline 2023 ACES ENGAGE

DENVER, Colo., Feb. 15, 2023 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced its speaker lineup for the upcoming ACES ENGAGE conference, taking place at the historic Broadmoor Hotel in Colorado Springs, May 17 - 19, 2023.

TrustEngine launches lending’s most comprehensive borrower intelligence platform (BIP)

OWINGS MILLS, Md., Feb. 15, 2023 (SEND2PRESS NEWSWIRE) -- Sales Boomerang and Mortgage Coach today announced their union under the new name TrustEngine™, an identity that embodies the merged organization's vision to help lenders drive undeniable value as clients' trusted financial advisors. The name also reflects the brand's heritage as a trusted service provider to mortgage lenders for more than a quarter-century.

MonitorBase Launches Instant Inquiry Alerts to Help Lenders Capture More Opportunities

MURRAY, Utah, Feb. 7, 2023 (SEND2PRESS NEWSWIRE) -- MonitorBase, a mortgage fintech company that monitors prescreened credit information and real-time behavioral data to alert lenders when one of their contacts is in the market to purchase or refinance a home, today announced the launch of instant credit inquiry alerts for their mortgage lender clients.

MMI adds Carol Burke as Regional Director of Enterprise Sales

SALT LAKE CITY, Utah, Jan. 30, 2023 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced today that Carol Burke has been appointed regional director of enterprise sales. As part of the enterprise sales team, Burke is tasked with expanding MMI's growing roster of mortgage enterprise clients, which now includes 20 of the top 25 lenders in the nation, while also driving brand awareness and adoption in mortgage-related verticals, such as title and insurance.

Down Payment Resource’s Q4 2022 Homeownership Program Index shows homebuyer assistance programs have increased in number for fifth consecutive quarter

ATLANTA, Ga., Jan. 26, 2022 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from its latest Homeownership Program Index (HPI). The firm's analysis of 2,351 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 1.82% from Q3 to Q4 2022.

MCT First to Integrate with Freddie Mac’s Income Limits API

SAN DIEGO, Calif., Jan. 24, 2023 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, is pleased to announce it is the first secondary marketing platform to integrate with Freddie Mac's Income Limits application programming interface (API) created for the first-time home buyer area median income (AMI) limits. Income Limits allows for the accurate pricing of Credit Fee in Price (Exhibit 19, or "Credit Fees") waivers.

MMI Receives Growth Investment from WestView Capital Partners

SALT LAKE CITY, Utah and BOSTON, Mass., Jan. 20, 2023 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced today that it has received a growth investment from WestView Capital Partners (WestView), a Boston-based private equity firm focused exclusively on middle market growth companies.

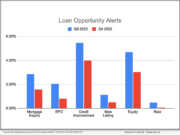

Sales Boomerang releases Q4 2022 Mortgage Market Opportunities Report

OWINGS MILLS, Md., and IRVINE, Calif., Jan. 19, 2023 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced the release of Sales Boomerang's latest Mortgage Market Opportunities Report.

ACES Quality Management expands client base by 22% in 2022

DENVER, Colo., Jan. 18, 2023 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the company had record growth increasing its client base by 22% amidst significant market volatility. The company also made numerous updates to its ACES Quality Management & Control® software and its free Compliance NewsHub resource, in addition to launching its inaugural ACES ENGAGE conference.

Housing Finance Strategies Announces #HousingDC23

WASHINGTON, D.C., Jan. 18, 2023 (SEND2PRESS NEWSWIRE) -- Housing Finance Strategies Founder & CEO Faith Schwartz today announced the return of the highly successful #HousingDC conference on September 26-27, 2023. More than 2,000 viewers participated in #HousingDC22 presented last September ahead of the midterm elections and post event attendee surveys confirmed high demand for continued delivery.

Michigan Mortgage Lenders Association kicks off 2023 with new logo, branding

SHELBY TOWNSHIP, Mich., Jan. 12, 2023 (SEND2PRESS NEWSWIRE) -- The Michigan Mortgage Lenders Association (MMLA), the only Michigan-based association dedicated solely to the housing finance industry, unveiled an updated logo and brand identity for 2023. The brand refresh aligns with the organization's new purpose and direction as the connection point, legislative voice and educational resource for Michigan's real estate finance economy.