Tag: Mortgage

Mortgage Coach enhances integration with Black Knight’s Surefire to support lenders with mortgage education that helps convert borrowers at scale

IRVINE, Calif., March 1, 2022 (SEND2PRESS NEWSWIRE) -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, today announced an enhanced integration with Surefire, Black Knight's customer relationship management (CRM) and marketing automation software designed specifically for the mortgage lending industry.

FormFree names former ICE finance executive Patrick Rutherford as CFO to fuel its next stage in company growth

ATHENS, Ga., March 1, 2022 (SEND2PRESS NEWSWIRE) -- FormFree® today announced that it has appointed Patrick Rutherford, former finance executive at Intercontinental Exchange (NYSE: ICE), as chief financial officer (CFO). In his new role at FormFree, Rutherford will lead the organization's finance, accounting and compliance functions.

Sales Boomerang teams up with OptifiNow to offer lenders an integrated experience for mortgage customer engagement

BALTIMORE, Md., Feb. 22, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced its application programming interface (API) integration with OptifiNow, a cloud-based sales, marketing and customer relationship management (CRM) platform. The integration ensures accurate borrower data flows seamlessly and automatically between the two systems, giving lenders more time to focus on nurturing borrower relationships and exceeding sales goals.

FormFree’s AccountChek joins forces with Freddie Mac for industry-first automated assessment of direct deposit income

ATHENS, Ga., Feb. 18, 2022 (SEND2PRESS NEWSWIRE) -- FormFree® today announced that its AccountChek® digital asset verification service will support a first-of-its-kind solution from Freddie Mac that allows mortgage lenders to assess a prospective homebuyer's income using direct deposit data. Available to mortgage lenders nationwide, Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution fulfills mortgage verification of assets (VOA) and verification of income (VOI) requirements.

National Bankers Association Endorses Promontory MortgagePath for Mortgage Fulfillment Services and POS Technology

DANBURY, Conn., Feb. 17, 2022 (SEND2PRESS NEWSWIRE) -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC today announced the National Bankers Association (NBA) has endorsed its mortgage fulfillment services and proprietary point-of-sale technology, Borrower Wallet®.

#HousingDC22 Announces New Sponsors and Political Commentator Amy Walter

WASHINGTON, D.C., Feb. 15, 2022 (SEND2PRESS NEWSWIRE) -- Housing Finance Strategies President Faith Schwartz made two key announcements today regarding the firm's annual housing policy and technology event on September 26-27, 2022. Amy Walter is the national editor of the Cook Political Report and a frequent on-air analyst.

Spring EQ Offers Home Equity Loans to Brokers in Lender Price’s Marketplace

PASADENA, Calif., Feb. 11, 2022 (SEND2PRESS NEWSWIRE) -- Lender Price, a provider of mortgage loan pricing and origination technology, announced today that Spring EQ has joined the Lender Price Marketplace as the first home equity loan lender on the platform. Spring EQ, headquartered in Philadelphia, is one of the nation's largest lenders of home equity products.

New Jersey Bankers Association endorses Promontory MortgagePath’s mortgage fulfillment services and POS technology

DANBURY, Conn., Feb. 11, 2022 (SEND2PRESS NEWSWIRE) -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today the New Jersey Bankers Association (NJBankers) has officially endorsed its mortgage fulfillment services and proprietary point-of-sale technology Borrower Wallet®.

ACES Quality Management adds Mortgage Bankers Association Economist Dr. Edward Seiler to ACES ENGAGE agenda

DENVER, Colo., Feb. 10, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced it has added Dr. Edward Seiler, housing economist at the Mortgage Bankers Association (MBA) and executive director of the MBA's think tank Research Institute for Housing America, to its speaker line-up for the upcoming ACES ENGAGE conference.

Mortgage Coach expands partnership with NAMMBA to grow diversity, equity and inclusion in housing finance

IRVINE, Calif., Feb. 8, 2022 (SEND2PRESS NEWSWIRE) -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, has expanded its relationship with the National Association of Minority Mortgage Bankers of America (NAMMBA).

ReverseVision Recruits Marketing Maven Scott Shepherd to Elevate Brand and Support Growth

SAN DIEGO, Calif., Feb. 3, 2022 (SEND2PRESS NEWSWIRE) -- ReverseVision®, the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, announced that seasoned marketing executive Scott Shepherd has joined the company to head its marketing efforts. As head of marketing, he oversees ReverseVision's marketing department and is responsible for the design and implementation of its new marketing strategy.

Mortgage Coach unveils redesigned website

IRVINE, Calif., Feb. 2, 2022 (SEND2PRESS NEWSWIRE) -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, has announced the launch of a newly designed website. The website redesign offers visitors an enhanced user experience featuring immersive brand exploration opportunities and an enriched library of lender resources.

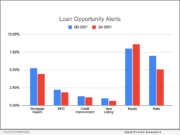

Sales Boomerang releases Q4 2021 Mortgage Market Opportunities Report

WASHINGTON, D.C., Jan. 31, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. The Q4 2021 report identified increasing opportunities for mortgage lenders to assist borrowers with tappable home equity, lending credence to analysts' expectations for a surge in home-equity-related mortgage activity in 2022.

IDS expands mortgage eClosing platform with addition of eVault

SALT LAKE CITY, Utah, Jan. 25, 2022 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced today that it has released its eVault, expanding the capabilities of its eClosing platform, Solitude Solution. With the addition of the eVault to Solitude Solution, lenders now have the ability to deliver documents, including eNotes, to partners though Mortgage Electronic Registration Systems, Inc. (MERS) eRegistry.

TMC Emerging Technology Fund LP Invests in Capacity

SAN DIEGO, Calif., Jan. 25, 2022 (SEND2PRESS NEWSWIRE) -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") recently participated in a $38M Series C investment round for AI Software, LLC dba Capacity. Capacity is an AI-powered support automation platform.

Nomis Solutions Appoints Fintech Veteran George Neal as Chief Product Officer, Promotes Prashant Balepur to SVP, Corporate Strategy and Partnerships

SAN FRANCISCO, Calif., Jan. 20, 2022 (SEND2PRESS NEWSWIRE) -- Nomis Solutions (Nomis), a global, industry-leading pricing and profitability management solutions provider, recently announced the appointment of George Neal as chief product officer. In this role, Neal will oversee strategy and development for new and existing products across all Nomis industry verticals.

ReverseVision Hires Industry Veteran Steve Butler as Director of Business Development

SAN DIEGO, Calif., Jan. 20, 2022 (SEND2PRESS NEWSWIRE) -- ReverseVision®, the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, announced that it added long-time mortgage professional Steve Butler to the company's sales team, who brings more than 35 years of experience to the company. ReverseVision has been adding resources in key functional areas as part of its strategic expansion plan.

Vice Capital Markets breaks internal trading volume record in 2021, helps clients achieve peak profitability

NOVI, Mich., Jan. 12, 2022 (SEND2PRESS NEWSWIRE) -- Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today that the company set a new internal trade volume record last year, trading more than $202 billion on behalf of its full service clients. Using an advantageous mix of delivery and execution, the company was able to help its clients capitalize profitably on each trade.

Housing Finance Strategies Announces #HousingDC22

WASHINGTON, D.C., Jan. 12, 2022 (SEND2PRESS NEWSWIRE) -- Housing Finance Strategies President Faith Schwartz today announced that the firm will host its annual housing policy and technology event on September 26-27, 2022. The returning support of #HousingDC22 sponsors is notable and a testament to the quality of the event.

Promontory MortgagePath promotes Kevin Wheeler to managing director

DANBURY, Conn., Jan. 5, 2022 (SEND2PRESS NEWSWIRE) -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today it has promoted Kevin Wheeler to managing director of product and engineering. Wheeler previously held the position of director of backend engineering at Promontory MortgagePath.