Tag: Mortgage

Digital Mortgage Provider Maxwell Extends Product Offering with New Fulfillment Platform

DENVER, Colo., May 19, 2020 (SEND2PRESS NEWSWIRE) -- Digital mortgage provider Maxwell today announced a new way for small and midsize lenders to scale processing capacity to meet market needs through the launch of the Maxwell Fulfillment Platform.

NEXT™ Team Adds Staff to Expand Digital Footprint

EDMOND, Okla., May 15, 2020 (SEND2PRESS NEWSWIRE) -- NEXT Mortgage Events LLC (NEXT™), creator of NEXT women's executive mortgage summit and NEXTMortgageNews.com, has announced that it has added two key positions to support the expansion of its digital footprint.

ARMCO Launches ACESXPRESS for Early Payment Defaults

DENVER, Colo., May 13, 2020 (SEND2PRESS NEWSWIRE) -- ACES Risk Management (ARMCO), the leading provider of enterprise quality management and control software for the lending industry, announced the release of ACESXPRESS for Early Payment Defaults (EPDs) to bolster lenders' existing audit programs in light of the recent increases in required monthly EPD audit volume.

Top of Mind wins eight international Hermes Awards for SurefireCRM’s creative videos that help mortgage lenders engage prospects and customers

ATLANTA, Ga., May 12, 2020 (SEND2PRESS NEWSWIRE) -- Top of Mind Networks (Top of Mind), a leader in customer relationship management (CRM) and marketing automation software for the mortgage lending industry, was recognized with four platinum and four gold awards for outstanding corporate marketing in the 2020 Hermes Creative Awards.

Altavera Founder Brian Simons joins Maxwell executive team

DENVER, Colo., May 12, 2020 (SEND2PRESS NEWSWIRE) -- Digital mortgage leader Maxwell has announced Altavera Mortgage Services founder and former CEO Brian Simons has joined the company as president. Simons comes to Maxwell with 23 years of experience in the mortgage industry, including capital markets, loan origination and default management.

Top of Mind enhances ‘Client for Life’ Workflow to help lenders retain 2020’s record-breaking influx of refi customers

ATLANTA, Ga., May 5, 2020 (SEND2PRESS NEWSWIRE) -- Top of Mind Networks, a leader in customer relationship management (CRM) and marketing automation software for the mortgage lending industry, today announced enhancements to its "Client for Life" Workflow. Available to users of SurefireCRM, the Client for Life Workflow helps lenders protect market share by creating over 100 distinct opportunities to stay connected with borrowers over a five-year period.

IDS Expands eClosing Platform to Include eNotes, Rebrands as Solitude Solution

SALT LAKE CITY, Utah, May 4, 2020 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has expanded the capabilities of its eClose platform to include eNotes. Recently branded as Solitude Solution, the platform's eClosing capabilities allow lenders and borrowers to execute loans digitally.

ARMCO Launches ACES Consumer™ Quality Management Platform for Financial Institutions

DENVER, Colo., April 22, 2020 (SEND2PRESS NEWSWIRE) -- ACES Risk Management (ARMCO), the leading provider of enterprise quality management and control software for the lending industry, announced the official release of ACES Consumer, the next iteration of its ACES Audit Technology platform designed specifically for financial institutions.

FormFree and Ocrolus Partner for Comprehensive Borrower Income Verification Program

ATHENS, Ga., April 21, 2020 (SEND2PRESS NEWSWIRE) -- FormFree, a leading fintech provider of credit decisioning services, today announced a partnership with Ocrolus, a leading fintech infrastructure company that transforms documents into actionable data with over 99% accuracy.

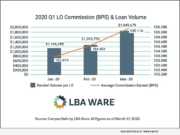

LBA Ware Issues Q1 2020 LO Compensation Report

MACON, Ga., April 17, 2020 (SEND2PRESS NEWSWIRE) -- LBA Ware, a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry compensation in the first quarter of 2020.

Global DMS Receives Innovations Award from PROGRESS in Lending for EVO Appraisal Management Software

LANSDALE, Pa., April 14, 2020 (SEND2PRESS NEWSWIRE) -- Global DMS, a leading provider of cloud-based appraisal management software, announced that it has been selected by PROGRESS in Lending for its "Innovations Award," which recognizes companies that have come together to create something truly game-changing for the mortgage space.

Nationwide Equities Taps ReverseVision Private Program Support to Launch ‘EquityPower’ Private Reverse Mortgage Program

SAN DIEGO, Calif., April 14, 2020 (SEND2PRESS NEWSWIRE) -- ReverseVision, the leading provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, today announced that Nationwide Equities Corporation (Nationwide Equities) has leveraged ReverseVision's private product support to launch its own private reverse mortgage program, EquityPower.

MQMR Adds Mortgage-Focused Social Media Monitoring Platform

LOS ANGELES, Calif., April 13, 2020 (SEND2PRESS NEWSWIRE) -- Mortgage Quality Management and Research, LLC (MQMR) announced today that it has added ActiveComply, a social media monitoring platform, to its suite of audit, risk and compliance-focused solutions for financial institutions and independent mortgage lenders.

OpenClose honored as a 2020 HWTech100 Mortgage Innovator

WEST PALM BEACH, Fla. /Florida Newswire/ -- OpenClose, the leading mortgage fintech provider and omni-channel loan origination system (LOS), announced that due to its industry-pioneering technology innovations, successful launches and the resulting stellar lender outcomes, the company was named to the prestigious HousingWire 2020 Mortgage Tech 100 List.

NotaryCam CEO Rick Triola Named ‘Tech All-Star’ by Mortgage Bankers Association for Second Time in His Career

NEWPORT BEACH, Calif., April 2, 2020 (SEND2PRESS NEWSWIRE) -- NotaryCam, the pioneering leader in online notarization and original provider of mortgage eClosing solutions, announced that its founder and CEO Rick Triola is one of the five mortgage technology innovators honored by the Mortgage Bankers Association (MBA) as a 2020 Tech All-Star.

MQMR Promotes Mabel Lee to Head of Warehouse Due Diligence, Adds Scott Weintraub to Lead Internal Audit Department

LOS ANGELES, Calif., April 2, 2020 (SEND2PRESS NEWSWIRE) -- Mortgage Quality Management and Research, LLC (MQMR) announced today that it has promoted Mabel Lee to Warehouse Due Diligence Manager and hired Scott Weintraub as Internal Audit Manager.

ARMCO Updates ACES IQ to Provide Guidance on Regulatory Changes Made in Response to COVID-19 National Emergency Declaration

DENVER, Colo., April 2, 2020 (SEND2PRESS NEWSWIRE) -- ACES Risk Management (ARMCO), the leading provider of enterprise financial risk mitigation solutions, announced it has created a new question set category within its ACES Intelligent Questionnaire (ACES IQ) functionality to house all temporary regulatory provisions issued by state and federal agencies and the GSEs in response to the COVID-19 national emergency declaration.

Top of Mind gives loan originators must-have text messaging capabilities with SurefireCRM Power Messaging

ATLANTA, Ga., April 1, 2020 (SEND2PRESS NEWSWIRE) -- Top of Mind Networks (Top of Mind), a leader in customer relationship management (CRM) and marketing automation software for the mortgage lending industry, today announced the release of Power Messaging, a feature that enables SurefireCRM users to deliver high-touch text communication to consumers at scale.

FormFree Expands Partnership with American Red Cross of Northeast Georgia in Celebration of 2020 Red Cross Month

ATHENS, Ga., March 31, 2020 (SEND2PRESS NEWSWIRE) -- FormFree® today announced it is celebrating Red Cross Month by expanding its long-held partnership with the American Red Cross of Northeast Georgia. FormFree will support the Northeast Georgia chapter's mission of alleviating human suffering in the face of emergencies by giving fiscal contributions and engaging in monthly acts of service throughout 2020.

Alpine Bank Selects CompenSafe by LBA Ware for Efficient, Accurate and Scalable Compensation Plan Management

MACON, Ga., March 26, 2020 (SEND2PRESS NEWSWIRE) -- LBA Ware™, a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, announced that full-service community bank Alpine Bank has implemented CompenSafe™ to automate incentive compensation for its mortgage loan originators and fulfillment staff.