Tag: Reports and Studies

43 new assistance programs were added during the first quarter of 2025, expanding support for more homebuyers : National News

ATLANTA, Ga., April 22, 2025 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q1 2025 Homeownership Program Index (HPI) report. The report saw the number of entities offering homebuyer assistance programs increase by 55 year-over-year (YoY). The number of programs increased by 43 during the first quarter, bringing the total number of available programs to 2,509.

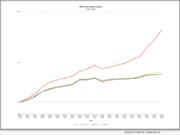

Cooler Interest Rates Heat Up Refinances and Spark Early Signs of Purchase Demand : National News

PLANO, Texas, April 8, 2025 (SEND2PRESS NEWSWIRE) -- Optimal Blue today released its March 2025 Market Advantage mortgage data report, showing a 24% surge in rate lock volume as early spring buyers returned to the market and homeowners jumped at the chance to refinance into lower rates. While still down 2% on a year-over-year (YoY) basis, purchase volumes were up 21% month-over-month (MoM). Rate-and-term and cash-out refinances jumped 52% and 20% MoM, respectively, together representing 25% of all lock activity.

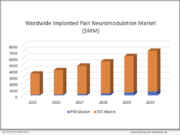

Pain Neuromodulation Market to Reach $6.5 Billion by 2030 : National News

SAN FRANCISCO, Calif., March 31, 2025 (SEND2PRESS NEWSWIRE) -- Neurotech Reports, the publisher of the newsletter Neurotech Business Report, announced the availability of a new market research report that forecasts the growth of the worldwide market for implanted pain neuromodulation systems. According to the newly published report, "The Market for Implanted Pain Neuromodulation Systems: 2025-2030," the worldwide market will be $3.37 billion in 2025, growing to $6.49 billion by 2030, which represents a 12% compound annual growth rate.

VALUECOM Releases New Study on the Rise of ‘Buy Now, Pay Later’ (BNPL) and Its Impact on Consumer Spending : National...

NEW YORK, N.Y., March 11, 2025 (SEND2PRESS NEWSWIRE) -- VALUECOM has released a comprehensive study on the growing adoption of Buy Now, Pay Later (BNPL) services, a payment method that has reshaped consumer spending habits and merchant strategies worldwide. As BNPL continues to gain traction, it is becoming a preferred financial tool for shoppers looking for flexible and interest-free installment payment options.

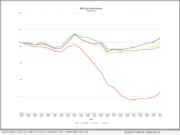

MCT Reports 28% Increase in Mortgage Lock Volume Heading into Spring Season : National News

SAN DIEGO, Calif., March 11, 2025 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% increase in mortgage lock volume compared to the previous month. Industry professionals and stakeholders are encouraged to download the full report for a detailed analysis.

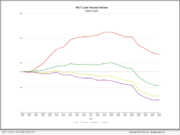

40% Jump in Rate-and-Term Refis Drives Overall Lock Growth as Purchase Activity Stalls : National News

PLANO, Texas, March 11, 2025 (SEND2PRESS NEWSWIRE) -- Optimal Blue today released its February 2025 Market Advantage mortgage data report, showing a 7% month-over-month increase in mortgage lock volume driven primarily by a surge in refinance activity. Rate-and-term refinances saw the biggest jump, rising nearly 40% as homeowners seized the opportunity to lower their monthly payments. Cash-out refinances also edged higher, while purchase lock activity remained subdued for the second consecutive month.

2024-2025 Mortgage Industry Insights Released by The Mortgage Collaborative : National News

SAN DIEGO, Calif., Feb. 24, 2025 (SEND2PRESS NEWSWIRE) -- The Mortgage Collaborative (TMC), a leading network of mortgage lenders dedicated to innovation and collaboration, has released its latest Pulse of the Network report, offering key insights into the challenges and opportunities shaping the mortgage industry in 2025. The survey, conducted with decision-makers-including CEOs, COOs, and department heads from banks, credit unions, and independent mortgage banks (IMBs)-highlights how lenders are preparing for a shifting market landscape.

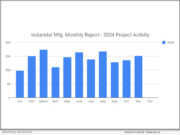

129 New U.S. Manufacturing Planned Industrial Projects Stays Steady to Start Jan. 2025 New Year

JACKSONVILLE BEACH, Fla. /FLORIDA NEWSWIRE/ -- Industrial SalesLeads announced today the January 2025 results for the new planned capital project spending report for the Industrial Manufacturing industry. The Firm monitors planned industrial capital projects across North America, encompassing facility expansions, new plant construction, and major equipment upgrades. Research confirms 129 new projects in the Industrial Manufacturing sector for the start of the new year.

ACES Q3 2024 Mortgage QC Trends Report shows ‘sharp rise in insurance defects’ for second time this year : National News

DENVER, Colo., Feb. 13, 2025 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the third quarter (Q3) of 2024. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

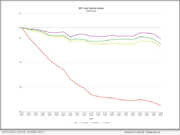

January Mortgage Lock Data Shows Year-Over-Year Improvement in Refinance Volume Despite Higher Rates : National News

PLANO, Texas, Feb. 13, 2025 (SEND2PRESS NEWSWIRE) -- Optimal Blue today released its January 2025 Market Advantage mortgage data report, revealing a sharp rise in year-over-year (YoY) refinance activity alongside a drop in purchase lock counts. The decline in purchase lock counts marks the lowest January count since Optimal Blue began tracking this data in 2019. Meanwhile, refinance lock volume surged even though the Optimal Blue Mortgage Market Indices (OBMMI) 30-year ticked above 7% for the first time since May.

Millionaire Mastermind Academy Expands National Impact, Empowering Over 8,000 Minority Women Entrepreneurs : National News

ATLANTA, Ga., Feb. 10, 2025 (SEND2PRESS NEWSWIRE) -- Millionaire Mastermind Academy (MMA), a nationally recognized nonprofit organization, has released its 2023-2024 Annual Impact Report, underscoring its proprietary entrepreneur curriculum and the power of strategic national partnerships in creating pathways to financial independence for minority women entrepreneurs. MMA has supported over 8,000 entrepreneurs, empowering them with the education, mentorship, and resources needed to build and scale successful businesses.

Mortgage Lock Volume Stays Flat in Latest MCT February Indices : National News

SAN DIEGO, Calif., Feb. 6, 2025 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 0.12% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report for a deeper understanding of the latest market trends and dynamics.

LenderLogix Q4 2024 Homebuyer Intelligence Report Data Indicates Possible Improvement in Affordability : National News

BUFFALO, N.Y., Jan. 21, 2025 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the fourth quarter (Q4) of 2024.

172 new homebuyer assistance programs and 75 new program providers emerged in 2024 to tackle homeownership affordability : National News

ATLANTA, Ga., Jan. 21, 2025 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q4 2024 Homeownership Program Index (HPI) report. The report saw the number of homebuyer assistance programs increase by 172 and the number of entities offering them increase by 75 year-over-year (YoY), bringing the total number of available programs to 2,466.

MCT Reports 16% Decrease in Mortgage Lock Volume Amid Market Dynamics : National News

SAN DIEGO, Calif., Jan. 14, 2025 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 16.7% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report to gain comprehensive insights into the evolving market dynamics.

December Mortgage Lock Data Reveals Year-Over-Year Increases Across All Loan Types Despite Seasonal Downturn : National News

PLANO, Texas, Jan. 14, 2025 (SEND2PRESS NEWSWIRE) -- Optimal Blue today released its December 2024 Market Advantage mortgage data report, showcasing year-over-year (YoY) growth in mortgage activity, even as seasonal trends led to a month-over-month (MoM) decline in rate lock volumes. Overall, December mortgage lock volume was up 26% YoY, driven by an 18% increase in purchase locks, a 43% rise in cash-out refinances, and an 82% jump in rate-and-term refinances.

Publishers Newswire announces BOOKS TO BOOKMARK List for Q4 2024: 15 Great Reads to Check Out : National News

TEMECULA, Calif., Dec. 23, 2024 (SEND2PRESS NEWSWIRE) -- Publishers Newswire (PNW), an online news publisher covering books, music, indie film, and software launched in 2004, has announced its latest quarterly "books to bookmark" list for Q4 (Oct.-Dec.) 2024, noting 15 new and interesting "good reads" from small publishers released in 2024. These new books are often overlooked due to not coming from major traditional book publishing houses.

MCT Reports a 15% Decrease in Mortgage Lock Volume Amid Higher Rates : National News

SAN DIEGO, Calif., Dec. 11, 2024 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, has announced a 15.12% decrease in mortgage lock volume compared to the previous month. The data, reflecting current market dynamics, is available in MCT's latest report, which offers in-depth analysis and insights for industry professionals and stakeholders.

Industrial Manufacturing Reports for Nov. 2024: Accelerated Growth for the Third Month with 151 New Projects Announced

JACKSONVILLE BEACH, Fla. /FLORIDA NEWSWIRE/ -- Industrial SalesLeads released its November 2024 report on planned capital project spending in the Industrial Manufacturing industry, highlighting a significant uptick in activity. The firm, which monitors North American industrial capital project plans, including facility expansions, new plant construction, and major equipment modernizations, identified 151 new projects for the month.

ACES Q2 2024 Mortgage QC Trends Report Reveals Second Consecutive Increase in Critical Defect Rate : National News

DENVER, Colo., Nov. 20, 2024 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the second quarter (Q2) of 2024. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software. ACES has altered the timing of this report to better reflect Fannie Mae's accelerated timeline for post-closing quality control reviews.