Mortgage Technologist Mark Michel Joins Growing Team at OpenClose

WEST PALM BEACH, Fla. /Florida Newswire/ -- OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that it hired Mark Michel, an industry veteran in enterprise-level mortgage technology systems.

PitBullTax Institute Announces Second 2018 User Conference: Tax Resolution Expert Program

FORT LAUDERDALE, Fla. /Florida Newswire/ -- PitBullTax Institute, an educational branch of the well-established IRS Tax Resolution Software, organizes its Second PitBullTax User Conference: "Tax Resolution Expert Program." It will take place on September 20-21-22, 2018 at the Hilton Fort Lauderdale Beach Resort. This conference is designed exclusively for existing and potential users of PitBullTax Software.

Introducing Aclaro TrueView: a Fintech Solution Designed to Revolutionize Lending Risk Analysis

MIAMI, Fla. /Florida Newswire/ -- Aclaro, a leading provider in blockchain-based open platform solutions, recently released its latest A.I. solution. The new tool, Aclaro TrueView is designed to provide automotive and other lenders with a competitive advantage through robust features that save them time, money, and facilitate better lending decisions.

Aclaro to Bring Predictive Analytics to Lending Sector, Expands Operations in the US

MIAMI, Fla. /Florida Newswire/ -- Aclaro, the leading provider of blockchain based open data platforms and solutions, has announced that it has launched a new Fintech Artificial Intelligence (AI) solution focused on the lending industry. The new solution is Aclaro TrueView. Aclaro aims to equip lenders with the innovative tools needed for competitive advantage with its tech savvy, blockchain based predictive analytics platform that can be utilized without incurring heavy costs.

PitBullTax Software Expands its Power with Release of Latest Version 4.0

CORAL SPRINGS, Fla. /Florida Newswire/ -- PitBullTax Software, the leading IRS Tax Resolution Software for CPAs, EAs and Tax Attorneys, just released its new and more feature rich Version 4.0. For nine years PitBullTax Software has transformed the tax resolution business by making it more efficient and intuitive for tax professionals to solve their clients' IRS problems.

Ascend Federal Credit Union Automates its Residential Mortgage Lending Business with OpenClose’s LenderAssist and DecisionAssist

WEST PALM BEACH, Fla. /Florida Newswire/ -- OpenClose(R), an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that Ascend Federal Credit Union (Ascend) is leveraging its LenderAssist(TM) LOS platform and DecisionAssist(TM) product and pricing engine (PPE). OpenClose's completely browser-based solution has delivered additional efficiencies and heightened service levels for the credit union's growing mortgage lending division.

Ready for Next Tax Season? New TaxBird Tax App Designed for People with Homes in More than One State

NAPLES, Fla. /Florida Newswire/ -- With this year's tax season in the rear-view mirror, there's no better time to start prepping for the next round. TaxBird - a new tax app developed by ware2now, LLC - helps people with homes in more than one state ensure they don't exceed their residency threshold. It's useful to tax professionals and estate planners too.

PitBullTax Software Announces PitBullTax University, Lauches Its First User Conference

CORAL SPRINGS, Fla. /Florida Newswire/ -- PitBullTax Software, The Leading IRS Tax Resolution Software provider for CPAs, Enrolled Agents and Tax Attorneys received accreditation to be a Continuing Education Provider for tax professionals who are involved in IRS tax resolution and for those who plan to practice in this lucrative specialty. This is yet another milestone in a long history of accomplishments for PitBullTax, and another example of how this company maintains its dominant position in the tax resolution arena.

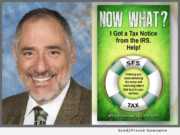

Life-preserving 2018 tax tips, quips and advice series, book one from Jeffrey Schneider, is now available in a Kindle Edition

STUART, Fla. /Florida Newswire/ -- SFS Tax Problem Solutions Press announces the release of the eBook and Kindle Edition of "Now What? I Got a Tax Notice from the IRS. Help!" (B079XWL8P9) by Jeffrey Schneider. "Now What?" is also available in paperback (ISBN: 978-0692997154) and will be published in an audiobook version in June 2018.

Nationally Recognized Speakers Lined-Up for Ave Law’s Fifth Annual Estate Planning Conference

NAPLES, Fla. /Florida Newswire/ -- Leading National Estate Planning Influencers Paul Lee, Stacy Eastland and Mark Parthemer are among the top speakers in the line-up for Ave Maria School of Law’s Fifth Annual Estate Planning Conference to be held on Friday, April 27, 2018 at The Ritz-Carlton Beach Resort, 280 Vanderbilt Beach Road, Naples.

New Book ‘Now What? I Got a Tax Notice from the IRS. Help!’ released today by Jeffrey Schneider EA

STUART, Fla. /Florida Newswire/ -- SFS Tax Problem Solutions Press announces the release of "Now What? I Got a Tax Notice from the IRS. Help!" (ISBN: 978-0692997154) by Jeffrey Schneider. "Now What?" is available nationwide today in paperback. It will be published in an eBook edition in March and an audio book edition in June 2018.

OpenClose Bolsters Software Integration and Support Teams for its Loan Origination System (LOS)

WEST PALM BEACH, Fla. /Florida Newswire/ -- OpenClose(R), an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that it has added staff to its integration and customer support departments. The new hires will help enhance OpenClose's existing software products, facilitate digital mortgage processes, produce fintech-level innovation and provide excellence in customer support. The company also recently added three senior software engineers to its development team.

Claim Forward asks: Will Victims of Irma Also Be Subject to Insurance Policy Renewal Surcharges?

BRADENTON, Fla. /Florida Newswire/ -- Nearly 500,000 residential property owners across the State of Florida have already incurred substantial out-of-pocket expenses due Irma losses because of high hurricane claim deductibles, according to Consumer Insurance Trust LLC (Claim Forward). The standard hurricane deductible across most insurers is usually 2 percent of the dwelling value.

IRS Lien and Levy Holiday is over says Jeffrey Schneider EA – If you owe back taxes, notices are coming again...

STUART, Fla. /Florida Newswire/ -- After a temporary break during the hurricanes and the holidays, the Liens, Levies and Garnishments that were held back by the IRS are starting again and will be en route to your mailbox to those that owe back taxes, says Jeffrey Schneider EA, CTRS, NTPI Fellow, and principal at SFS Tax Problem Solutions.

OpenClose Adds AFR Flood Services to its LenderAssist LOS

WEST PALM BEACH, Fla. /Florida Newswire/ -- OpenClose, a multi-channel loan origination system (LOS) and mortgage software solutions provider, announced that it partnered with AFR Services (AFR) to enable customers to access the company's complete suite of flood services. Using the interface makes it quick and easy to order AFR's various flood services directly from within OpenClose's LenderAssist(tm) LOS.

Mid America Mortgage Partners with NASCAR, Richard Petty Motorsports, Launches Click n’ Close

DAYTONA BEACH, Fla. /Florida Newswire/ -- Click n' Close(TM), a division of Mid America Mortgage, Inc., has entered into official partnership agreements with the sanctioning body, NASCAR, and one of the most iconic race teams in the sport, Richard Petty Motorsports. The collaborations designate Click n' Close as the "Official Mortgage Provider of NASCAR(R)" in addition to becoming a partner of Richard Petty Motorsports.

ARMCO Promotes Phil McCall to President, will expand company’s award-winning ACES Audit Technology platform

POMPANO BEACH, Fla. /Florida Newswire/ -- ACES Risk Management (ARMCO), the leading provider of financial quality control and compliance software ACES Audit Technology(TM), announced that chief operating officer Phil McCall has been promoted to company president. In his new role, McCall will oversee all operations for the company, including the expansion of the company's award-winning ACES Audit Technology platform.

QuestSoft and OpenClose Webinar to Focus on the New CFPB HMDA Rules

WEST PALM BEACH, Fla. /Florida Newswire/ -- OpenClose, a multi-channel loan origination system (LOS) provider, and QuestSoft, a provider of automated mortgage compliance software, announced that they will host a joint webinar covering the new CFPB HMDA regulations, how they will impact organizations, and outline specific plans to make compliance with the new HMDA rules the most efficient and time-saving process in the mortgage industry.

ARMCO: TRID and Loan Package Documentation Defects Comprise Over 68 Percent of Reported Defects

POMPANO BEACH, Fla. /Florida Newswire/ -- ACES Risk Management (ARMCO), the leading provider of financial quality control and compliance software, announced it has released the ARMCO Mortgage QC Industry Trends Report for the fourth quarter of 2016 and calendar year 2016.

Innovative Insurance Business, LevelFunded Health Selected For Plug and Play Insurtech Program

BOCA RATON, Fla. /Florida Newswire/ -- LevelFunded Health is excited to announce that it was recently selected as one of the new top innovative insurance businesses by one of Silicon Valley's most active venture group, Plug and Play. The 12-week program connects promising start-ups, early and growth stage companies, to some of the world's largest insurance corporations.