Tag: DepthPR

TrustEngine launches lending’s most comprehensive borrower intelligence platform (BIP)

OWINGS MILLS, Md., Feb. 15, 2023 (SEND2PRESS NEWSWIRE) -- Sales Boomerang and Mortgage Coach today announced their union under the new name TrustEngine™, an identity that embodies the merged organization's vision to help lenders drive undeniable value as clients' trusted financial advisors. The name also reflects the brand's heritage as a trusted service provider to mortgage lenders for more than a quarter-century.

MMI adds Carol Burke as Regional Director of Enterprise Sales

SALT LAKE CITY, Utah, Jan. 30, 2023 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced today that Carol Burke has been appointed regional director of enterprise sales. As part of the enterprise sales team, Burke is tasked with expanding MMI's growing roster of mortgage enterprise clients, which now includes 20 of the top 25 lenders in the nation, while also driving brand awareness and adoption in mortgage-related verticals, such as title and insurance.

Down Payment Resource’s Q4 2022 Homeownership Program Index shows homebuyer assistance programs have increased in number for fifth consecutive quarter

ATLANTA, Ga., Jan. 26, 2022 (SEND2PRESS NEWSWIRE) -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from its latest Homeownership Program Index (HPI). The firm's analysis of 2,351 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 1.82% from Q3 to Q4 2022.

MMI Receives Growth Investment from WestView Capital Partners

SALT LAKE CITY, Utah and BOSTON, Mass., Jan. 20, 2023 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced today that it has received a growth investment from WestView Capital Partners (WestView), a Boston-based private equity firm focused exclusively on middle market growth companies.

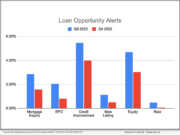

Sales Boomerang releases Q4 2022 Mortgage Market Opportunities Report

OWINGS MILLS, Md., and IRVINE, Calif., Jan. 19, 2023 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced the release of Sales Boomerang's latest Mortgage Market Opportunities Report.

Nomis Solutions Elevates Johnathan Bant to Head of Client Relations for Financial Services Market in Canada

TORONTO, Ontario and SAN FRANCISCO, Calif., Jan. 19, 2023 (SEND2PRESS NEWSWIRE) -- Nomis Solutions (Nomis), the leading provider of end-to-end pricing lifecycle management technology, announced industry veteran Johnathan Bant will serve as Head of Client Relations for Canada. In this role, Bant is responsible for leading Canadian engagements across Nomis' client portfolio as well as non-customer financial institutions (FIs) across the country.

ACES Quality Management expands client base by 22% in 2022

DENVER, Colo., Jan. 18, 2023 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the company had record growth increasing its client base by 22% amidst significant market volatility. The company also made numerous updates to its ACES Quality Management & Control® software and its free Compliance NewsHub resource, in addition to launching its inaugural ACES ENGAGE conference.

Michigan Mortgage Lenders Association kicks off 2023 with new logo, branding

SHELBY TOWNSHIP, Mich., Jan. 12, 2023 (SEND2PRESS NEWSWIRE) -- The Michigan Mortgage Lenders Association (MMLA), the only Michigan-based association dedicated solely to the housing finance industry, unveiled an updated logo and brand identity for 2023. The brand refresh aligns with the organization's new purpose and direction as the connection point, legislative voice and educational resource for Michigan's real estate finance economy.

TMC Emerging Technology Fund LP Invests in TRAiNED

SAN DIEGO, Calif., Jan. 12, 2023 (SEND2PRESS NEWSWIRE) -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") recently participated in a $1 million Simple Agreement for Future Equity (SAFE) funding round for TRAiNED, Inc.

Shelli Holland joins Sales Boomerang and Mortgage Coach as Chief People Officer

OWINGS MILLS, Md. and IRVINE, Calif., Dec. 22, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced the appointment of Shelli Holland to the role of Chief People Officer.

Critical Defect Rates Rose 6% in Q2 2022 Per ACES Quality Management Mortgage QC Industry Trends Report

DENVER, Colo., Dec. 15, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the second quarter (Q2) of 2022. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

ACES Quality Management Upgrades ACES CONNECT® to Enhance Communication, Collaboration on Quality Control Findings

DENVER, Colo., Dec. 8, 2022 (SEND2PRESS NEWSWIRE) -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced it has enhanced its proprietary ACES CONNECT portal to extend its flexibility and user control capabilities. This enhancement allows ACES administrators to create custom user roles and assign permissions for those roles to fit the needs of their organization.

Sales Boomerang and Mortgage Coach’s Jacob Gibbs and Kassy Scarcia recognized for achievements in mortgage technology

OWINGS MILLS, Md., and IRVINE, Calif., Dec. 7, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today celebrated two of its team members for earning recognition for their respective contributions to the mortgage industry. Senior Director of Integrations Jacob Gibbs was named a 2022 Tech Trendsetter by HousingWire (HW), and Customer Success Team Manager Kassy Scarcia was selected to National Mortgage Professional's (NMP's) 2022 40 Under 40 list.

Sales Boomerang and Mortgage Coach add Casey Martin to the executive team as chief revenue officer

OWINGS MILLS, Md., and IRVINE, Calif., Dec. 7, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced the appointment of Casey Martin as chief revenue officer.

HousingWire Magazine selects MMI Founder, Ben Teerlink, as a 2022 Tech Trendsetter

SALT LAKE CITY, Utah, Dec. 6, 2022 (SEND2PRESS NEWSWIRE) -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announces its founder and CEO Ben Teerlink has been selected by housing industry publication HousingWire in its annual Tech Trendsetters award program. This award honors leaders that have played an integral role in bringing innovative solutions to market for the housing industry.

Sales Boomerang Ranked Number 162 Fastest-Growing Company in North America on the 2022 Deloitte Technology Fast 500™

OWINGS MILLS, Md., and IRVINE, Calif., Nov. 17, 2022 (SEND2PRESS NEWSWIRE) -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced that Sales Boomerang ranked No. 162 on the 2022 Deloitte Technology Fast 500™, a ranking of the 500 fastest-growing technology, media, telecommunications, life sciences, fintech, and energy tech companies in North America, now in its 28th year.

NotaryCam’s ‘Help a Hero’ initiative returns with complimentary online notarization for active duty and retired service members

NEWPORT BEACH, Calif., Nov. 9, 2022 (SEND2PRESS NEWSWIRE) -- NotaryCam®, a Stewart-owned company and a pioneering provider of remote online notarization and identity verification / authentication technology for real estate and legal transactions, today announced its semi-annual "Help a Hero" initiative will run Friday, November 11 through Sunday, November 13, 2022, and once again offer free remote online notarization (RON) sessions to United States veterans and current service members.

Technology Association of Iowa selects iEmergent as a 2022 Prometheus Award winner

DES MOINES, Iowa, Nov. 7, 2022 (SEND2PRESS NEWSWIRE) -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced that it has been named the 2022 FinTech & InsurTech Company of the Year in the Technology Association of Iowa's (TAI's) annual Prometheus Awards program.

Click n’ Close launches proprietary SmartBuy loan suite to provide low- and moderate-income homebuyers with more affordable mortgage options

ADDISON, Texas, Nov. 2, 2022 (SEND2PRESS NEWSWIRE) -- Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, announces it has launched SmartBuy, a suite of loan programs designed to give low and moderate-income (LMI) homebuyers an advantage in today's heightened mortgage interest rate environment.

FormFree expands its verification of income and employment network through partnership with Truv

ATHENS, Ga., Nov. 1, 2022 (SEND2PRESS NEWSWIRE) -- FormFree® announced that it has partnered with Truv to enhance AccountChek®'s verification of income and employment (VOI/E) reporting capabilities with Truv's payroll provider network, expanding the modern convenience of electronically sharing payroll data with mortgage lenders to 120 million workers.