Tag: Digital Mortgage

Blue Sage Solutions and The Mortgage Collaborative Partner to Bring Interim Servicing to their Members

ENGLEWOOD CLIFFS, N.J., March 22, 2024 (SEND2PRESS NEWSWIRE) -- The Mortgage Collaborative, the nation's largest independent mortgage cooperative, announced the addition of Blue Sage Solutions, an industry leader in innovative cloud-based technology providers, to bring interim servicing to the mortgage industry. The partnership makes the Blue Sage Digital Servicing Platform (DSP), a cloud-based system that provides all necessary functions to perform interim servicing, available to TMC members at preferred rates.

FormFree appoints Solvent CEO DIVINE as head of culture

ATHENS, Ga., Dec. 6, 2023 (SEND2PRESS NEWSWIRE) -- FormFree® today announced the appointment of former hip-hop/rap recording artist-turned-techpreneur Victor D. Lombard, professionally known as DIVINE, as head of culture. DIVINE is the CEO and founder of Solvent, a fintech focused on financial empowerment for marginalized groups.

Premium Mortgage Corporation taps LenderLogix’s LiteSpeed to power Digital-First Mortgage Borrowing Experience

BUFFALO, N.Y., June 28, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Rochester, N.Y.-based Premium Mortgage Corporation (Premium Mortgage) is the latest mortgage lender to implement its streamlined point-of-sale (POS) platform LiteSpeed to provide borrowers with a white-labeled, digitally-driven mortgage application experience.

Peak Residential Lending Builds Digital-First Mortgage Borrowing Experience Using LenderLogix Product Suite

BUFFALO, N.Y., April 27, 2023 (SEND2PRESS NEWSWIRE) -- LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced Peak Residential Lending has implemented its complete application suite - LiteSpeed, QuickQual and Fee Chaser - into its existing tech stack to power a digital-first borrower experience.

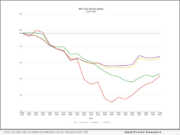

MCTlive! Lock Volume Indices: October 2022 Data

SAN DIEGO, Calif., Nov. 3, 2022 (SEND2PRESS NEWSWIRE) -- MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for October 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

FormFree names former ICE finance executive Patrick Rutherford as CFO to fuel its next stage in company growth

ATHENS, Ga., March 1, 2022 (SEND2PRESS NEWSWIRE) -- FormFree® today announced that it has appointed Patrick Rutherford, former finance executive at Intercontinental Exchange (NYSE: ICE), as chief financial officer (CFO). In his new role at FormFree, Rutherford will lead the organization's finance, accounting and compliance functions.

National Bankers Association Endorses Promontory MortgagePath for Mortgage Fulfillment Services and POS Technology

DANBURY, Conn., Feb. 17, 2022 (SEND2PRESS NEWSWIRE) -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC today announced the National Bankers Association (NBA) has endorsed its mortgage fulfillment services and proprietary point-of-sale technology, Borrower Wallet®.

IDS expands mortgage eClosing platform with addition of eVault

SALT LAKE CITY, Utah, Jan. 25, 2022 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced today that it has released its eVault, expanding the capabilities of its eClosing platform, Solitude Solution. With the addition of the eVault to Solitude Solution, lenders now have the ability to deliver documents, including eNotes, to partners though Mortgage Electronic Registration Systems, Inc. (MERS) eRegistry.

Promontory MortgagePath Founder and CEO Eugene Ludwig honored as top technology executive by Northern Virginia Technology Council

DANBURY, Conn., Nov. 17, 2021 (SEND2PRESS NEWSWIRE) -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today its Founder and CEO Gene Ludwig was named one of the top technology executives by the Northern Virginia Technology Council (NVTC) as part of its annual NVTC Tech 100 awards.

Promontory MortgagePath Promotes Dean McCall into its C-Suite as Chief Information Officer

DANBURY, Conn., Nov. 10, 2021 (SEND2PRESS NEWSWIRE) -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today it has promoted Dean McCall from managing director of development operations and data to chief information officer (CIO).

Fintech provider Promontory MortgagePath’s digital mortgage and fulfillment solutions receive renewed ABA endorsement

DANBURY, Conn., Nov. 4, 2021 (SEND2PRESS NEWSWIRE) -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced the renewal of its product endorsement by the American Bankers Association (ABA). Promontory MortgagePath combines extensive mortgage operations and compliance expertise with industry-leading mortgage technology to provide efficient, cost-effective mortgage processing and fulfillment services to lenders of all sizes.

FormFree integration with OpenClose enhances lending experience with quick and easy borrower-permissioned data verification

ATHENS, Ga., Nov. 1, 2021 (SEND2PRESS NEWSWIRE) -- FormFree® Founder and CEO Brent Chandler today announced the availability of its AccountChek® financial data verification service within OpenClose®, the leading fintech provider of mortgage software solutions for banks, credit unions and mortgage lenders. The integration embeds AccountChek into OpenClose's ConsumerAssist(tm) Enterprise POS and LenderAssist(tm) LOS, giving borrowers the freedom to electronically permission verification data with ease when applying for a mortgage loan.

Global DMS’ EVO® enhances efficiency and mobility with Amazon’s Alexa Voice Command Interface

LANSDALE, Pa., Oct. 18, 2021 (SEND2PRESS NEWSWIRE) -- Global DMS, the leading provider of cloud-based real estate appraisal management software, recently announced that its next-generation EVO platform is now voice-enabled, providing lenders access to key functionality and up to the minute information of their entire pipeline with Amazon's Alexa voice control - making EVO the first and only appraisal management software to provide this capability in the mortgage industry.

Promontory MortgagePath Promotes Bryan DeShasier to Chief Administrative Officer, Adds Helen Placente as Managing Director of National Credit Operations

DANBURY, Conn., Sept. 23, 2021 (SEND2PRESS NEWSWIRE) -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced two key staffing changes expanding the strength of its executive team. Bryan DeShasier has been promoted to Chief Administrative Officer (CAO), and Helen Placente has been hired as Managing Director of National Credit Operations.

Mid America Mortgage Adds Pete Jackson as Divisional Director for Wholesale/Non-Delegated Correspondent Channel, Tim Frohock as Regional Director

ADDISON, Texas, Sept. 1, 2021 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. (Mid America) announced today that Pete Jackson has joined the company as a divisional director and Tim Frohock as a regional director. With more than 30 years of wholesale and correspondent lending experience, Jackson and Frohock will play a critical role in the continued growth and success of Mid America's wholesale/non-delegated correspondent lending channel.

Mid America Mortgage Securitizes Its First Ginnie Mae eNote with eCustodian Wilmington Trust

ADDISON, Texas, June 10, 2021 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. (Mid America) announced today that the company has completed its first Ginnie Mae eNote transaction with Wilmington Trust, an approved and active eCustodian under Ginnie Mae's Digital Collateral Initiative. Having announced its first eNote transaction in August 2016, this represents the next step in Mid America's ongoing digital mortgage adoption efforts across its retail, wholesale and correspondent lending channels.

Provident Funding Partners with Lender Price

PASADENA, Calif., April 8, 2021 (SEND2PRESS NEWSWIRE) -- Lender Price, a provider of mortgage loan pricing and origination technology, announced today that Provident Funding has joined the Lender Price Marketplace. Provident Funding has been committed to the wholesale channel since inception in 1992. The Lender Price Marketplace user base has doubled over the past 12 months with more than 5,700 brokers.

Promontory MortgagePath Appoints Savita Ilango as Chief Financial Officer

DANBURY, Conn., Feb. 11, 2021 (SEND2PRESS NEWSWIRE) -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and tech-driven fulfillment solutions, announced today it has hired Savita Ilango as chief financial officer. A financial industry veteran, Ilango brings unique perspectives for helping Promontory MortgagePath continue both on its growth trajectory and toward achieving its mission of changing the way lenders approach their mortgage business.

UniversalCIS Announces Acquisition of SharperLending

PHILADELPHIA, Pa., Jan. 14, 2021 (SEND2PRESS NEWSWIRE) -- UniversalCIS, a market leader in technology and solutions to the mortgage industry, is pleased to announce the acquisition of mortgage technology provider SharperLending. The SharperLending transaction, which follows the merger of Universal Credit, CIS Credit Solutions, and Avantus, provides further enhancements to the technology platform for UniversalCIS.

ReverseVision Announces New CEO Joe Langner

SAN DIEGO, Calif., Jan. 4, 2021 (SEND2PRESS NEWSWIRE) -- ReverseVision®, the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, announced the promotion of its president Joe Langner to president and chief executive officer. In this expanded role, Langner will lead ReverseVision's mission to empower America's seniors to use home equity as part of retirement finance.