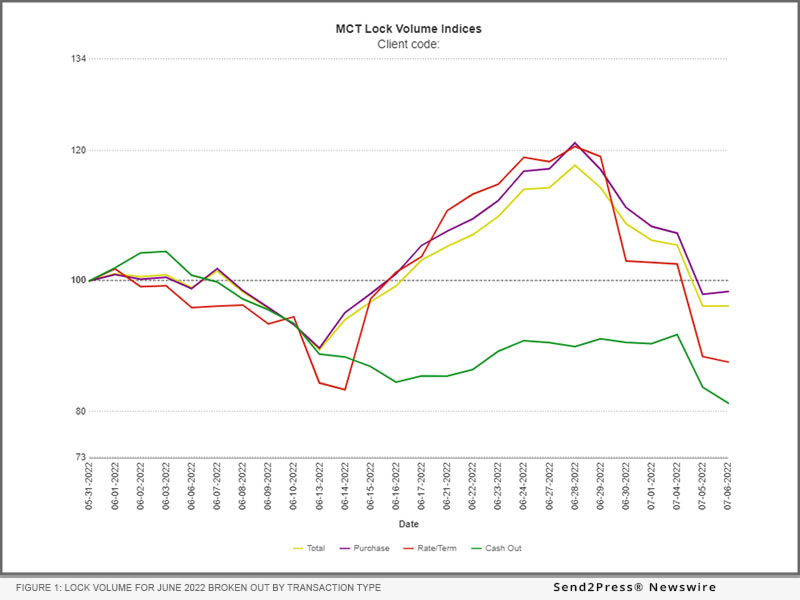

SAN DIEGO, Calif., Jul 11, 2022 (SEND2PRESS NEWSWIRE) — MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for June 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels. A broad-based view of the entire market provides a more accurate picture of mortgage originations versus indices that are influenced by mega lenders. The June MCTlive! Lock Volume Indices is broken out by transaction type: purchase, rate/term refinance, and cash out refinance.

June MCTlive! Lock Volume Indices show that that total mortgage rate locks by dollar volume decreased 3.8 percent in June, and total lock volume is down 32.0 percent from a year ago as purchases continue to make up most originator volume. Purchase locks declined 1.63 percent month-over-month, but a mere 4.6 percent from a year ago. The increase in mortgage rates is also evident as refinance volume continues to fall. Rate/term refinances are down 12.4 percent and cash out refinances are down 18.7 percent month-over-month. From one year ago, cash out refinance volume is down 64.5 percent, while rate/term refinance volume has dropped 90.4 percent. Given rate/term refinance volume was already down 90 percent year-over-year in the May MCTlive! Lock Volume Indices, this month’s drop does not change the total much. Please note that loan sizes were up 8.3 percent over the past year, with the average loan amount increasing from $291k to $315k.

It is important to note that MCT’s rate lock activity indices are based on actual dollar volume of locked loans, not number of applications. Especially in a tight purchase market, MCT believes its methodology (using actual loans locked vs. applications) is a more reliable metric. There is a higher likelihood of having multiple applications per funded loan, and prequals do not convert at as high of a rate in the current market as has historically been the case – especially when applications are counted at the early stage of entering a property address.

INDEX VALUES TO END MAY AS A PERCENTAGE BENCHMARKED TO THE START OF THE MONTH

Category | Month-Over-Month Index Value Change

Total: -3.83%

Purchase: -1.63%

Rate/Term Refinance: -12.43%

Cash Out Refinance: -18.74%

INDEX VALUE CHANGE YEAR-OVER-YEAR

Category | Year-Over-Year Index Value Change

Total: -32.03%

Purchase: -4.63%

Rate/Term Refinance: -90.39%

Cash Out Refinance: -64.47%

MCT will be publishing the MCTlive! Mortgage Lock Volume Indices monthly, intending the data to serve as an enduring informational tool for industry participants, analysts, and watchers.

About MCT:

Founded in 2001, Mortgage Capital Trading, Inc. (MCT)® has grown from a boutique mortgage pipeline hedging firm into the industry’s leading provider of fully integrated capital markets services and technology. MCT’s offerings include mortgage pipeline hedging, best execution loan sales, business intelligence and analytics, outsourced lock desk solutions, MSR valuation, hedging, and bulk sales, and the world’s first, truly open marketplace for loan sales. MCT supports independent mortgage bankers, depositories, credit unions, warehouse lenders, and correspondent investors of all sizes within its award-winning digital platform, MCTlive!®. Headquartered in sunny San Diego, MCT also has offices in Healdsburg, CA, Philadelphia, PA and Texas.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

News Source: Mortgage Capital Trading Inc.

Related link: https://mct-trading.com/

This press release was issued on behalf of the news source, who is solely responsible for its accuracy, by Send2Press Newswire. To view the original story, visit: https://www.send2press.com/wire/mctlive-lock-volume-indices-june-2022-data/