Tag: Mortgage

iEmergent honored with PROGRESS in Lending’s 2025 Connections Award | National News

DES MOINES, Iowa /Florida Newswire - National News/ -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced its selection as a recipient of PROGRESS in Lending's 2025 Connections Award. The recognition honors iEmergent's instrumental role in CONVERGENCE Columbus, a cross-sector initiative led by the Mortgage Bankers Association (MBA) to close the racial homeownership gap in Central Ohio.

Cloudvirga honored with PROGRESS in Lending’s 2025 Connections Award | National News

IRVINE, Calif. /Florida Newswire - National News/ -- Cloudvirga, a leading provider of digital mortgage point-of-sale platforms, today announced it has been named a recipient of PROGRESS in Lending's 2025 Connections Award. The award honors strategic partnerships and integrations that are reshaping the mortgage industry by advancing efficiency, innovation, and collaboration.

Optimal Blue Launches New Lead Generation Tool for Originators | National News

PLANO, Texas /Florida Newswire - National News/ -- Optimal Blue today announced a new product that helps originators efficiently track and identify refinance opportunities so they can reengage borrowers with eligible refinance options at the right time. Available to Optimal Blue PPE users, Capture for Originators dramatically reduces the manual effort loan officers currently spend evaluating refinance potential by automatically analyzing entire portfolios each month and putting recapture opportunities directly into originators' hands.

ACES Quality Management Champions Commitment to Lending Excellence at ACES ENGAGE 2025 | National News

DENVER, Colo. /Florida Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced official launch of its "I Stand for Quality" movement during its annual ACES ENGAGE conference, held May 18-20, 2025 at The Broadmoor Hotel in Colorado Springs.

HousingWire selects Depth EVP Lindsey Neal as 2025 Marketing Leader | National News

ATLANTA, Ga. /Florida Newswire - National News/ -- Depth, a leading provider of consultative B2B marketing, public relations and reputation management services for technology companies serving the residential mortgage finance, financial technology (fintech) and regulatory technology (regtech) industries, today announced that Executive Vice President Lindsey Neal has been named a recipient of HousingWire's 2025 Marketing Leaders Award.

Courtney Dodd of Floify named to HousingWire’s 2025 Marketing Leaders list for a second year in a row | National News

BOULDER, Colo. /Florida Newswire - National News/ -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that Courtney Dodd, head of marketing, has been named to HousingWire's prestigious Marketing Leaders list for 2025. She was also a 2024 Marketing Leaders recipient. The Marketing Leaders award honors the outstanding accomplishments of mortgage and real estate marketing executives who are the visionaries behind the strategies, campaigns and branding efforts that push the industry forward.

Click n’ Close Appoints Mortgage Wholesale Veteran Tony Catanese as Regional Sales Manager to Lead East Coast Expansion | National News

ADDISON, Texas /Florida Newswire - National News/ -- Click n' Close, a multi-state mortgage lender and innovator in third-party origination (TPO), announced Thursday that Tony Catanese has joined the company as regional sales manager. In this role, Catanese will lead the company's wholesale and non-delegated expansion across the East Coast, focusing on building and developing a high-performing sales team.

Friday Harbor unveils AI-powered condition engine to deliver faster, cleaner, audit-ready mortgage files | National News

SEATTLE, Wash. /Florida Newswire - National News/ -- Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the launch of a retooled condition engine that automatically generates actionable underwriting conditions based on borrower source documents and loan guidelines.

The Big Picture’s June conversations go deep on homeownership access, growth and market risk | National News

CLEVELAND, Ohio /Florida Newswire - National News/ -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, has unveiled its June guest lineup featuring four standout leaders whose insights are redefining housing access, real estate strategy and economic understanding. Co-hosted by mortgage business consultant and executive coach Rich Swerbinsky and capital markets authority Rob Chrisman, author of the widely read Chrisman Commentary newsletter, the webcast delivers timely, thought-provoking conversations with mortgage professionals, innovators and thought leaders.

SESLOC Credit Union Partners with Dovenmuehle to Enhance Mortgage Servicing for Members | National News

LAKE ZURICH, Ill. /Florida Newswire - National News/ -- Dovenmuehle Mortgage, Inc. (DMI), a leading mortgage subservicing company, today announced a partnership with SESLOC Credit Union, a not-for-profit financial cooperative serving central and coastal California communities. Under the agreement, DMI will subservice SESLOC's mortgage loan portfolio, supporting the credit union's expansion into government-sponsored enterprise (GSE) lending and servicing, allowing it to scale mortgage operations efficiently while preserving superior member service.

Argyle launches new integration, bringing real-time income and employment verification to Byte LOS customers | National News

NEW YORK CITY, N.Y. /Florida Newswire - National News/ -- Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, today announced a new integration with Byte Software's loan origination system (LOS). The integration enables lenders to access Argyle's real-time verification of income and employment (VOIE) services directly within the Byte platform, ensuring verification happens when and where it's needed to improve loan quality and keep loans moving forward.

Cloudvirga enhances lending efficiency with Encompass Docs Solution integration | National News

IRVINE, Calif. /Florida Newswire - National News/ -- Cloudvirga, a Stewart-owned provider of digital point-of-sale platforms for lenders, today announced a new integration using the latest API framework for mortgage technology from Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of data, technology and market infrastructure. Available via the Marketplace in the ICE digital lending platform, the integration expands the document provider options available to Cloudvirga customers and enhances lender efficiency and compliance by streamlining the generation, delivery and management of initial and revised disclosures.

Optimal Blue Releases Executive-Level AI Insights Tool, Ask Obi, to Clients | National News

PLANO, Texas /Florida Newswire - National News/ -- Optimal Blue today announced that Ask Obi, an AI-powered assistant designed to help mortgage lending executives extract real-time insights from across Optimal Blue's capital markets platform, is now generally available to all PPE clients. Introduced at the company's inaugural user conference in February and refined through beta testing with select clients, Ask Obi provides executives with fast answers to complex profitability questions at no additional cost.

Informative Research Integrates AccountChek® with Halcyon to Automate Income Validation | National News

GARDEN GROVE, Calif. /Florida Newswire - National News/ -- Informative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, today announced a strategic integration with Halcyon, a fintech innovator revolutionizing income verification through real-time access to IRS tax transcript data. This integration delivers verification of employment and income (VOE/I) reports-including payroll and paystub data-directly into Halcyon's income calculator, enabling faster, more automated income assessments.

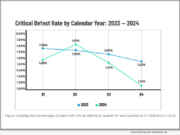

ACES Q4/CY 2024 Mortgage QC Industry Trends Report finds quarterly defect rate falls to 1.16% as annual loan quality improves |...

DENVER, Colo. /Florida Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and calendar year (CY) of 2024. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

ACES Quality Management Named One of 2025 Best Places to Work in Financial Technology for Third Consecutive Year | National News

DENVER, Colo. /Florida Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced that it has been named one of the 2025 Best Places to Work in Financial Technology. The annual awards program recognizes the leading companies in the financial technology sector that foster exceptional workplace experiences and support employee engagement satisfaction.

Argyle debuts integration with Encompass Consumer Connect, upgrades existing integration with Encompass from ICE Mortgage Technology | National News

NEW YORK CITY, N.Y. /Florida Newswire - National News/ -- Argyle, a service provider automating income and employment verifications for some of the largest lenders in the United States, today announced the debut of its integration with Encompass® Consumer Connect™, a digital mortgage point-of-sale solution from ICE Mortgage Technology®, part of Intercontinental Exchange (NYSE: ICE). In addition, Argyle announced the release of significant upgrades to its existing integration with ICE Mortgage Technology's flagship Encompass® loan origination system.

Lock Volume Rises 3.2% in April, Driven by Uptick in FHA Loans, Despite Economic Volatility | National News

PLANO, Texas /Florida Newswire - National News/ -- Optimal Blue today released its April 2025 Market Advantage mortgage data report showing total loan lock volume rose 3.2% month-over-month (MoM) as the spring homebuying season progressed, with purchase locks up 7.5% despite ongoing economic pressures.

Argyle integrates with Tidalwave to deliver embedded, real-time verification of income and employment | National News

NEW YORK CITY, N.Y. /Florida Newswire - National News/ -- Argyle, a service provider automating income and employment verifications for some of the largest lenders in the United States, today announced its integration with Tidalwave, an agentic AI mortgage point-of-sale (POS) platform. The integration embeds Argyle's verification of income and employment (VOIE) solution directly into Tidalwave's borrower workflow, eliminating manual steps and accelerating loan origination as lenders prepare for a more active housing market.

LenderLogix Q1 2025 Homebuyer Intelligence Report Shows Early 2025 Mortgage Market Momentum, Stronger Loan Engagement | National News

BUFFALO, N.Y. /Florida Newswire - National News/ -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the first quarter (Q1) of 2025.